Konvi, a pioneering platform in the luxury assets market, has expanded its reach and capabilities through the strategic acquisitions of Diversified and Fractible. These acquisitions not only enhance Konvi’s portfolio but also position it as a leader in the innovative luxury investment sector. This move marks a significant step in Konvi’s growth, aiming to broaden its influence and operational scope in the luxury market.

Table of Contents

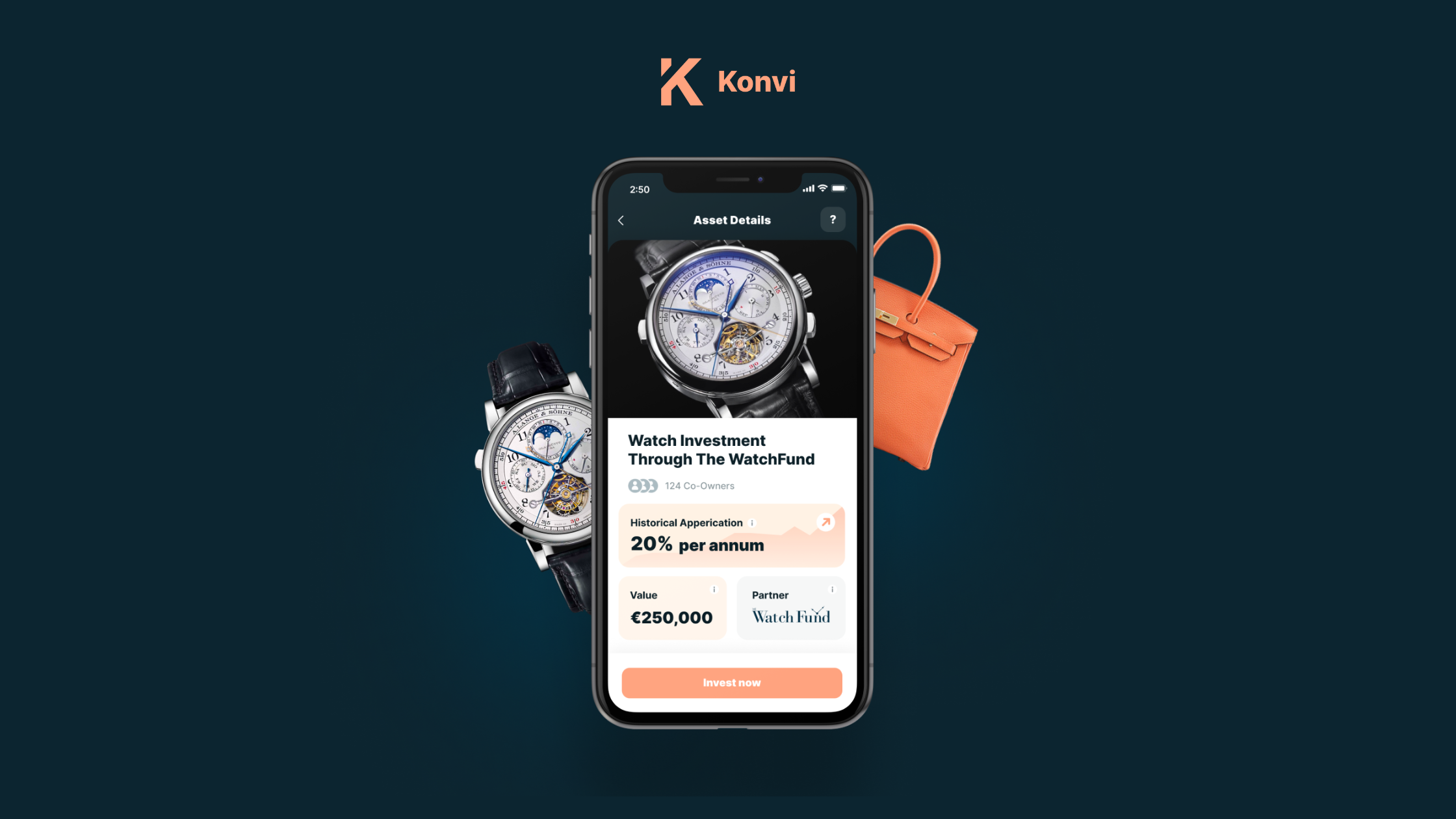

ToggleAbout Konvi

Founded in 2020 by a team of passionate entrepreneurs – Ioana Surdu-Bob, Eran Peer, and Lena Sonnen with the vision of making luxury asset investment accessible, Konvi leverages technology to offer fractional ownership of high-value assets. Based in a hub of financial innovation, Konvi has quickly distinguished itself in the fintech space through its user-friendly platform and diverse investment opportunities. The company, established by a team of entrepreneurs passionate about democratizing investment in luxury goods, has seen rapid growth, attracting both seasoned investors and new entrants to the market.

Overview of Acquired Companies: Diversified and Fractible

Diversified and Fractible, each with its unique business model, cater to niche segments within the luxury asset market. Diversified has developed a reputation for offering bespoke investment opportunities in rare and high-value items, while Fractible specializes in the digitalization of asset ownership through blockchain technology. These companies, headquartered in major financial cities, have complemented their innovative approaches with robust technological frameworks, making them attractive acquisition targets for Konvi.

Reasons Behind the Acquisitions

Konvi’s acquisition of Diversified and Fractible is driven by strategic motives aimed at enhancing its technological edge and diversifying its asset portfolio. By integrating Diversified’s bespoke investment options and Fractible’s blockchain technology, Konvi can offer more robust and secure investment opportunities. These acquisitions also allow Konvi to quickly scale operations and tap into new customer segments, fostering growth in both reach and financial performance.

Impact on the Market

The integration of Diversified and Fractible positions Konvi to redefine the landscape of luxury asset investments. This consolidation is likely to increase competitive pressures within the market, prompting other firms to innovate or consider similar growth strategies. For the luxury asset market, this could lead to more advanced technological integration and potentially lower entry barriers for new investors, thereby expanding the market base.

Customer Base and Expansion Strategy

Konvi’s customer base currently includes a diverse group of investors interested in luxury assets, ranging from art and antiques to high-end watches and cars. With the acquisition of Diversified and Fractible, Konvi aims to broaden its appeal to a wider demographic, including younger investors drawn to tech-driven investment platforms. The strategy includes not only expanding the variety of assets offered but also enhancing user experience with improved technology for asset management and trading.

Financial and Operational Insights

Although specific financial terms of the acquisitions have not been publicly disclosed, these moves are likely funded through a mix of equity and venture capital, given Konvi’s strong backing and previous funding rounds. Operationally, Konvi plans to integrate the teams and technologies of Diversified and Fractible, focusing on leveraging Fractible’s blockchain solutions to enhance the security and transparency of transactions on the Konvi platform.

Future Outlook and Developments

Post-acquisition, Konvi is set to launch several new initiatives aimed at solidifying its market position. These include expanding into new geographic markets and further developing its technology to include AI-driven investment analysis tools. Konvi’s leadership has expressed optimism about these developments, projecting significant growth in user base and transaction volumes over the next few years, which will likely establish Konvi as a key player in the global luxury investment market.

Conclusion

The strategic acquisitions of Diversified and Fractible mark a milestone in Konvi’s journey, enhancing its offerings and technological capabilities. These moves are expected to bring about a transformative change in the luxury asset investment space, broadening the market’s scope and making luxury investments more accessible to a global audience. As Konvi integrates these new assets and technologies, the industry watches closely to see how this ambitious strategy unfolds, potentially setting new standards for the entire sector.