In a significant development that underscores the vibrant and ever-evolving landscape of the fintech industry, Qonto, a prominent French fintech unicorn, has made headlines with its strategic acquisition of Regate, a company known for its innovative accounting and financial management solutions tailored for businesses. As reported by TechCrunch, this acquisition not only marks a pivotal moment in Qonto’s growth trajectory but also signals a broader shift in the fintech sector towards more integrated and comprehensive service offerings. The move is poised to redefine the way small and medium-sized enterprises (SMEs), startups, and freelancers manage their finances, merging Qonto’s robust banking platform with Regate’s expertise in financial management and automation.

Table of Contents

ToggleComprehensive Overview:

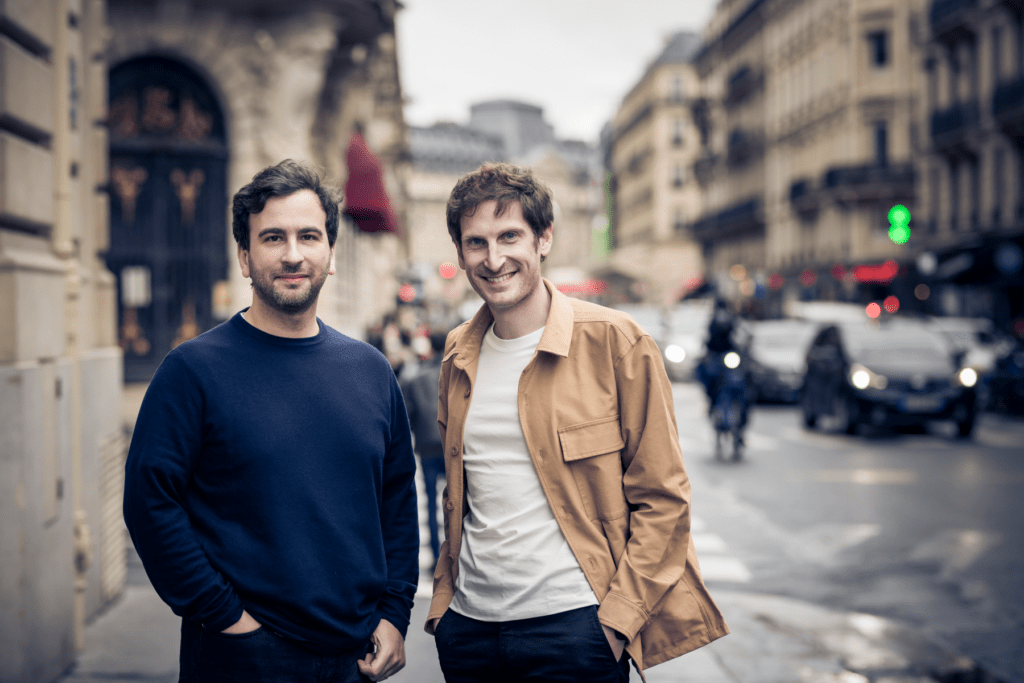

Qonto, founded in 2017 by Alexandre Prot and Steve Anavi, has rapidly emerged as a frontrunner in the fintech sector, offering streamlined banking services tailored to the needs of startups, SMEs, and freelancers. Its platform simplifies financial management through intuitive digital tools, enabling businesses to focus on growth rather than banking complexities. Regate, on the other hand, has carved out a niche in automating accounting and financial tasks, making it a complementary fit for Qonto’s expanding ecosystem.

Deep Dive:

- Countries and Customer Demographics: Both companies hail from France, a country that has become a hotbed for fintech innovation in Europe. Their services primarily target small to medium-sized enterprises (SMEs), startups, and freelancers, a demographic that often grapples with the intricacies of financial management and seeks efficient, user-friendly solutions.

- Historical Significance: The founding of Qonto and Regate marked significant milestones in the fintech evolution, addressing gaps in traditional banking services for businesses. Their growth trajectories reflect the increasing demand for specialized fintech solutions that cater to the unique needs of modern businesses.

- Business Models and Strategies: Qonto’s business model revolves around providing a digital-first banking experience, with a subscription-based pricing structure that offers clarity and predictability for businesses. Regate’s integration into Qonto’s suite of services is expected to enhance this model, offering a more holistic approach to financial management by bridging banking and accounting functionalities.

- Financial Implications: While specific financial details of the acquisition have not been disclosed, such strategic moves typically involve significant investment and are indicative of Qonto’s strong financial position and commitment to growth. The acquisition is expected to not only enhance Qonto’s product offerings but also expand its market reach and customer base.

Industry Trends and Potential Impacts:

The acquisition of Regate by Qonto is reflective of broader trends in the fintech industry, where consolidation and integration of services are becoming increasingly common. This trend is driven by the need to offer more comprehensive and seamless solutions to businesses, which demand efficiency and integration in their financial operations. The move is likely to spur further innovation and competition in the sector, as companies strive to meet the evolving needs of their customers.

Conclusion:

Qonto’s acquisition of Regate represents a strategic step forward in its mission to redefine banking for SMEs, startups, and freelancers. By combining their strengths, the two companies are poised to offer a more integrated and efficient financial management experience, setting a new standard in the fintech industry. As they embark on this new chapter, the broader implications for the fintech ecosystem, competition, and innovation are significant, signaling a future where financial management is more accessible, intuitive, and tailored to the needs of modern businesses.