Table of Contents

ToggleIntroduction

In a groundbreaking move, Revolut has unveiled its “Mobile Wallets” feature, setting a new benchmark in the realm of international money transfers. This innovative service is designed to streamline and simplify the process of sending money across borders, leveraging the robust SWIFT network to ensure efficiency and reliability.

The Innovation Behind Mobile Wallets

Simplifying International Transfers

Revolut’s Mobile Wallets revolutionize how users conduct international transactions. By eliminating the need for intricate bank details, this feature minimizes errors and accelerates the transfer process. Customers can now execute transactions using just the recipient’s name, phone number, or email address.

Targeting a Diverse Customer Base

The introduction of Mobile Wallets is particularly beneficial for expatriates and international students, offering a hassle-free method to manage finances abroad. This feature not only facilitates immediate transfers but also promises enhanced security and reduced costs, aligning with Revolut’s mission to make financial services more accessible.

Expanding Global Reach

Bridging Financial Gaps

With Mobile Wallets, Revolut targets key international corridors, initially enabling transfers to Kenya (M-Pesa) and Bangladesh (bKash). This strategic choice underscores Revolut’s commitment to addressing the financial needs of underbanked populations and fostering global financial inclusion.

Future Expansion Plans

Revolut’s vision extends beyond these initial markets, with plans to introduce Mobile Wallets in additional countries. This expansion strategy reflects the company’s ambition to redefine global finance, making it more inclusive and interconnected.

The Impact on Revolut’s Ecosystem

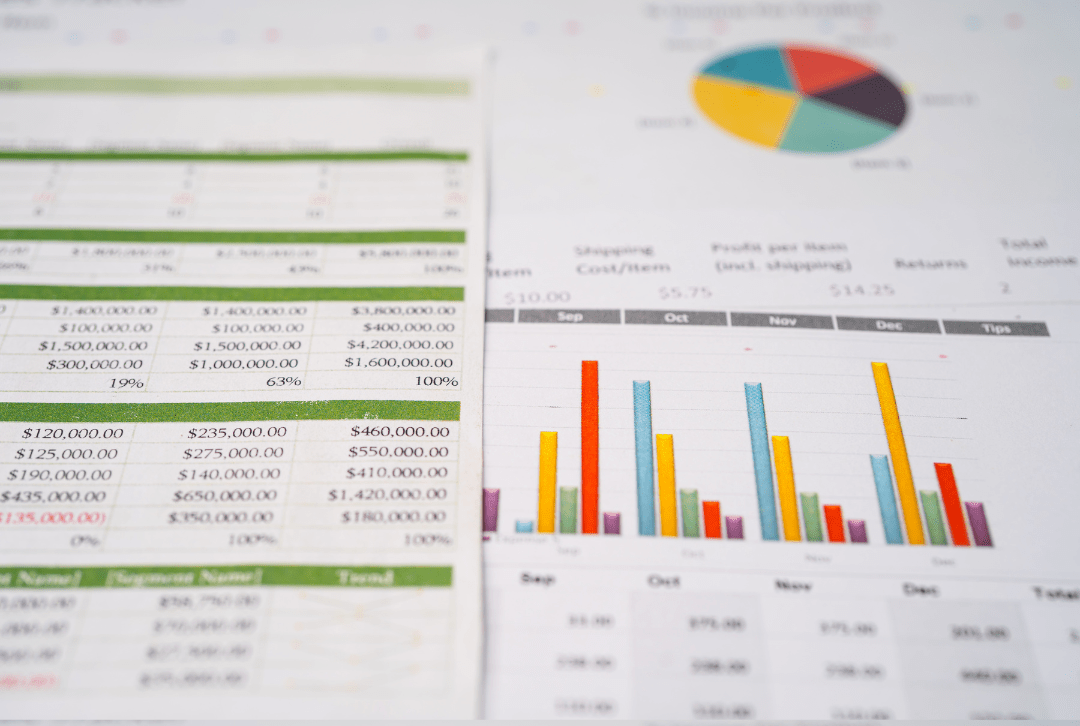

Boosting Transaction Volume

Revolut’s user base, already exceeding 35 million, is set to grow further as Mobile Wallets enhance the platform’s utility. This feature is expected to increase the volume of transactions, which currently stands at over 500 million monthly, showcasing the demand for more efficient and accessible financial services.

Strengthening User Engagement

By simplifying international transfers, Revolut increases its value proposition, encouraging users to engage more deeply with its suite of financial products. This, in turn, strengthens user loyalty and positions Revolut as a leading player in the fintech sector.

Understanding Revolut’s Fee Structure

Transparent and Competitive Fees

Revolut maintains transparency in its fee structure, ensuring users are aware of the costs associated with international transfers. The company’s competitive pricing model, including discounts for Premium and Metal plan subscribers, exemplifies its user-centric approach.

A Comparative Advantage

When compared to traditional banks and other fintech solutions, Revolut’s fee structure and service offerings present a compelling value proposition. The company’s focus on affordability and convenience is evident, making it a preferred choice for international money transfers.

Conclusion: A New Era for International Transfers

Revolut’s Mobile Wallets represent a significant leap forward in the fintech industry, offering an innovative solution to the challenges of cross-border payments. As the company continues to expand its services and reach, it solidifies its position as a key player in the global financial ecosystem, promising to deliver more accessible, efficient, and secure financial services to users worldwide.