Fidelity National Information Services, Inc. (FIS), a global leader in financial technology, has unveiled its groundbreaking initiative for 2024 – the FIS Fintech Hangout Series. This series aims to foster collaboration and growth within the fintech community, connecting startups, investors, and financial experts in a dynamic environment. This article delves into the intricacies of this innovative program, exploring its impact on the fintech ecosystem.

Table of Contents

ToggleThe Genesis of the FIS Fintech Hangout Series

Uniting the Fintech Community

Initiated in New York City with plans to extend to other major cities such as San Francisco, Chicago, Seattle, and Atlanta, the FIS Fintech Hangout Series is designed to bring together diverse fintech players. The series encourages meaningful conversations, exchange of best practices, and showcases the advancements made by participating fintech companies.

Supporting Through the FIS Fintech Accelerator Program

This initiative is a part of FIS’ ongoing commitment, spanning over nine years, to mentor and connect innovative fintech startups with the broader financial services sector. The FIS Fintech Accelerator Program, which has successfully graduated 80 companies, plays a pivotal role in this endeavor.

Key Features of the Series

Monthly Thematic Events

Each month, the series focuses on a specific theme crucial to the fintech industry. The inaugural event, for instance, centered on risk and compliance – a significant barrier for upcoming fintech firms. It provided insights into the complexities of financial regulations and how startups can navigate these challenges.

Spotlight on Success Stories

The series not only discusses challenges but also highlights success stories. A notable example is Themis, a 2022 graduate of the FIS Accelerator Program. Its Founder and CEO, Neepa Patel, shared valuable insights on complying with financial regulations and building trust with customers and regulators.

The FIS Fintech Accelerator Program

Nurturing Fintech Innovation

The FIS Fintech Accelerator Program is a 12-week intensive course designed to refine product models and scale businesses. It connects pre-vetted fintech companies with bankers, subject matter experts, and financial service executives to fine-tune their products to meet customer needs.

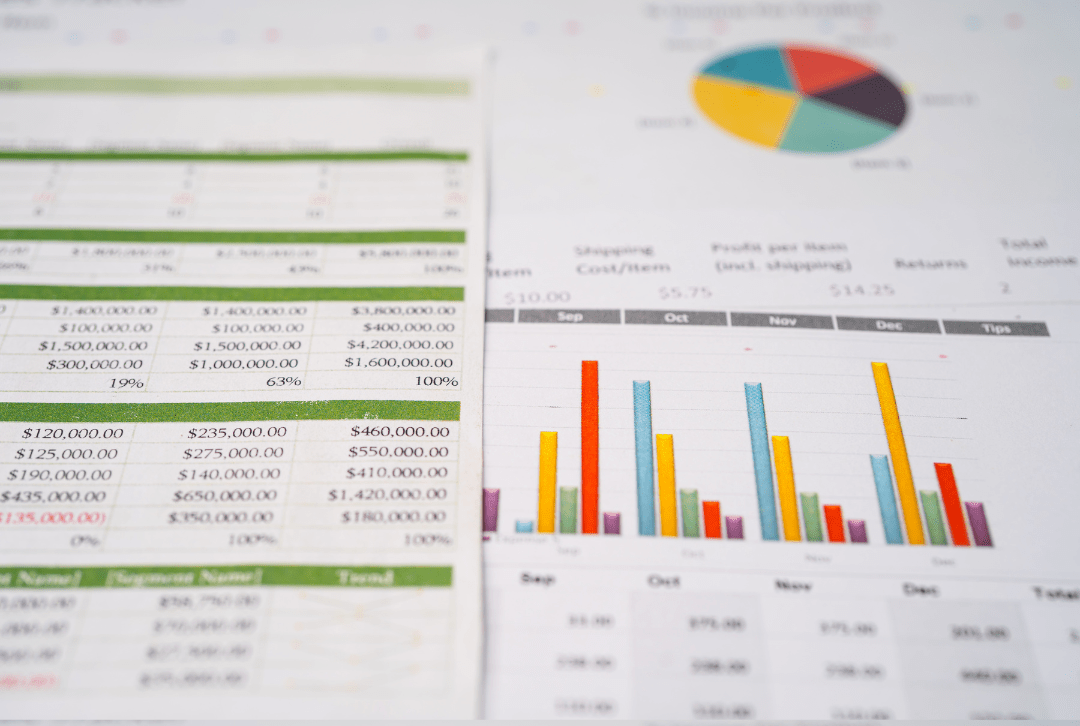

A Track Record of Success

Graduates of the program have shown remarkable success, with companies like Lama AI, Forage, Sardine, and Array making it to the coveted GGCV U.S 2024 Fintech Innovation 50 list.

Open Invitations for 2024 Cohort

Applications for the ninth cohort of the program open in March 2024. Interested fintechs can apply online or reach out to FIS for more information.

Upcoming Events and Participation

Expanding Geographical Reach

The next Fintech Hangout is scheduled for February 13 in Atlanta at the Atlanta Tech Village, signifying the series’ commitment to expanding its geographical footprint.

Inclusive Participation

The series is open to everyone involved in launching, growing, or working with fintechs, ensuring a diverse and inclusive participation.

Conclusion

FIS: Pioneering Financial Technology

FIS, headquartered in Jacksonville, Florida, is a Fortune 500 company deeply committed to revolutionizing the way the world pays, banks, and invests. Through initiatives like the Fintech Hangout Series and the Fintech Accelerator Program, FIS is not just advancing technology but also nurturing a community that will shape the future of finance.

A Step Towards Financial Empowerment

The FIS Fintech Hangout Series stands as a testament to the company’s dedication to fostering innovation, collaboration, and growth in the fintech sector. It’s a beacon for startups navigating the complex financial landscape, offering guidance, mentorship, and an invaluable network to accelerate their journey towards success and financial empowerment.