The financial technology sector, after enjoying a prolonged period of rapid expansion, is currently navigating through a period of deceleration. This shift in pace is the result of a confluence of factors, including market adjustments, strenuous economic conditions, and a transformation in the attitudes of investors. McKinsey & Company, in their forward-looking analysis, suggests that despite the hurdles, the fintech landscape is rife with substantial opportunities waiting to be seized.

In their comprehensive study titled “Fintechs: A new paradigm of growth,” McKinsey & Company dissect the fintech sector’s journey and chart a course towards a future marked by sustainability and profitability.

The report chronicles the fintech industry’s significant growth in the latter half of the 2010s, with venture capital funding swelling by 17% annually from $19.4 billion in 2015 to $33.3 billion in 2020. This growth trajectory took a steep climb in 2021, bolstered by the COVID-19 pandemic, with investments soaring to $92.3 billion, a staggering 177% year-over-year increment.

Yet, the year 2022 brought with it a market correction and a challenging commercial climate, which applied the brakes to this explosive growth. The sector saw a downturn in investment and deal-making activities, a reduction in the birth rate of new unicorns, and a deceleration in initial public offerings and special purpose acquisition company (SPAC) listings. The year witnessed a 40% plunge in fintech funding to $55 billion.

Despite these headwinds, McKinsey & Company identifies a silver lining for fintech entities. The firm anticipates that fintech revenues will burgeon at nearly thrice the rate of traditional banking revenues from 2022 to 2028.

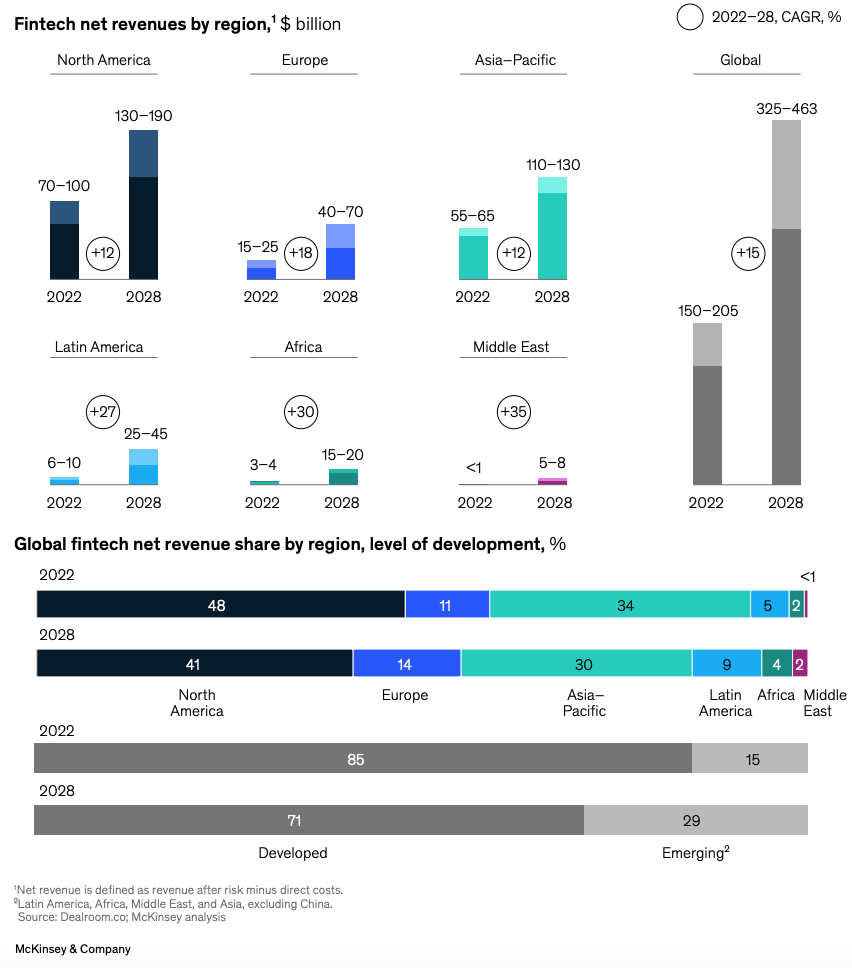

In 2022, fintechs carved out a 5% slice ($150 billion to $205 billion) of the global banking sector’s net revenue pie. McKinsey & Company projects this slice to expand beyond $400 billion by 2028, translating to a 15% annual growth rate for fintech revenues over the period, outstripping the broader banking industry’s growth rate of approximately 6%.

Emerging markets are expected to be the engines of this revenue growth. In regions such as Africa, Asia-Pacific (excluding China), Latin America, and the Middle East, fintech revenues accounted for 15% of the global revenue last year. By 2028, this is anticipated to swell to 29%. Conversely, North America’s share of the global fintech revenue is predicted to shrink from 48% in 2022 to 41% by 2028.

This anticipated growth is largely attributed to the profound digital transformation underway in the banking sector. Digital interactions have become the norm, with approximately 73% of banking engagements now occurring through digital channels.

The report also highlights the growing consumer trust in fintech companies, which is now on par with that of traditional banks. A survey conducted by McKinsey & Company in 2021 revealed that 41% of retail consumers are planning to increase their engagement with fintech products.

The demand for fintech solutions is not limited to individual consumers. In the business-to-business (B2B) arena, especially among small and medium-sized enterprises (SMEs), there is a growing appetite for fintech offerings. In 2022, 35% of SMEs in the United States were considering fintech for lending, competitive pricing, and platform integration. In Asia, 20% of SMEs were utilizing fintech for payments and lending.

Two particular verticals within the B2B fintech sector are poised for continued growth: banking-as-a-service (BaaS) and embedded finance, as well as SME and corporate value-added services. The demand in the BaaS and embedded finance segment is being driven by customer-facing businesses eager to control the end-to-end user experience and generate new revenue streams. Meanwhile, the SME segment remains a largely untapped market by traditional financial institutions, presenting a ripe opportunity for fintech solutions.

In the face of a more challenging funding environment, McKinsey & Company advises fintech companies to pivot towards prioritizing revenue generation and profitability. This entails establishing a strong and stable core business with a clear market fit before considering expansion, implementing rigorous cost management, and embedding a profitability perspective throughout the business.

Fintech firms are also encouraged to maintain their agility, innovative spirit, and culture, which have been central to their disruptive impact thus far. Embracing technologies such as generative artificial intelligence and refining operating models for greater agility and flexibility are recommended strategies.

Lastly, McKinsey & Company notes that some fintech companies may leverage the current venture capital slowdown and global market volatility to pursue mergers and acquisitions, acquiring smaller entities at reduced prices to consolidate market positions, acquire new technologies, or enter new customer segments.

A study by international law firm White & Case highlighted the dynamic mergers and acquisitions landscape within Europe’s fintech sector, with over 55 consolidation deals recorded in the preceding 15 months and more than 20 significant partnerships announced in the past year to explore new niches and technological capabilities.