Table of Contents

ToggleThe Dawn of CBDCs: A Global Trend

IMF’s Vision for Digital Finance

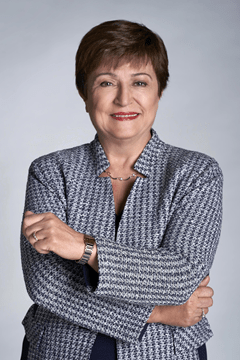

Kristalina Georgieva, the IMF’s Managing Director, in her keynote at the Singapore FinTech Festival, highlighted the untapped potential of digital money, urging for accelerated progress in the sector. This stance resonates with the IMF’s ongoing commitment to exploring and regulating Central Bank Digital Currencies (CBDCs).

Global Landscape of CBDC Adoption

Currently, about 60% of countries are exploring CBDCs, yet only 11 have fully adopted them. Georgieva emphasized CBDCs’ role in enhancing resilience in advanced economies and promoting financial inclusion for the underbanked and unbanked.

CBDCs: More Than Just Digital Cash

CBDCs vs. Private Digital Currencies

Georgieva asserted that CBDCs, offering a safer and more cost-effective alternative to private digital currencies, could bridge the gap between private monies and traditional financial systems. She called for an entrepreneurial mindset in policy decisions to ensure the successful integration of CBDCs.

Will you, fintech leaders and developers, spend the resources that are necessary to onboard merchants so they accept CBDCs? Will you make it easy for CBDCs to be integrated into financial services and messaging apps so people can pay each other from any environment? Fair enough, it will depend on the returns of your investments.– Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF)

The Role of Technology in Advancing CBDCs

AI and CBDCs: Partners in Inclusion

AI’s potential to enhance financial inclusion through credit scoring and personalized support was a key focus. Georgieva stressed the need for caution in deploying AI, emphasizing privacy and data security.

Project Guardian: Singapore’s Leap into Digital Finance

Singapore’s Monetary Authority, through Project Guardian, is exploring asset tokenization and DeFi applications, prioritizing risk mitigation. The IMF’s involvement in this project marks its active role in shaping the international monetary system.

CBDCs in Cross-Border Payments: Breaking Barriers

Enhancing Global Payments

Georgieva highlighted the need for efficient cross-border payments, crucial for global economic growth. She proposed the development of new platforms in collaboration with banks and fintech companies, envisioning them as next-generation virtual town squares.

The Road Ahead: Challenges and Opportunities

Navigating the Digital Landscape

While both the public and private sectors are actively involved in CBDC development, Georgieva suggested that more guidance is needed from public organizations to ensure safety and efficiency.

Integrating RegTech for Compliance

Tying back to AI, solutions like RegTech could reduce compliance costs, akin to priority lanes in airports. Georgieva called for open-mindedness and collaboration across sectors for the successful integration of CBDCs and cross-border platforms.

Conclusion: Steering Towards a Digital Future

The IMF’s advocacy for CBDCs at the Singapore FinTech Festival marks a significant step in the global financial sector’s evolution. By fostering collaboration and innovation, the world is steering towards a more inclusive and efficient digital financial ecosystem.