Table of Contents

ToggleIntroduction

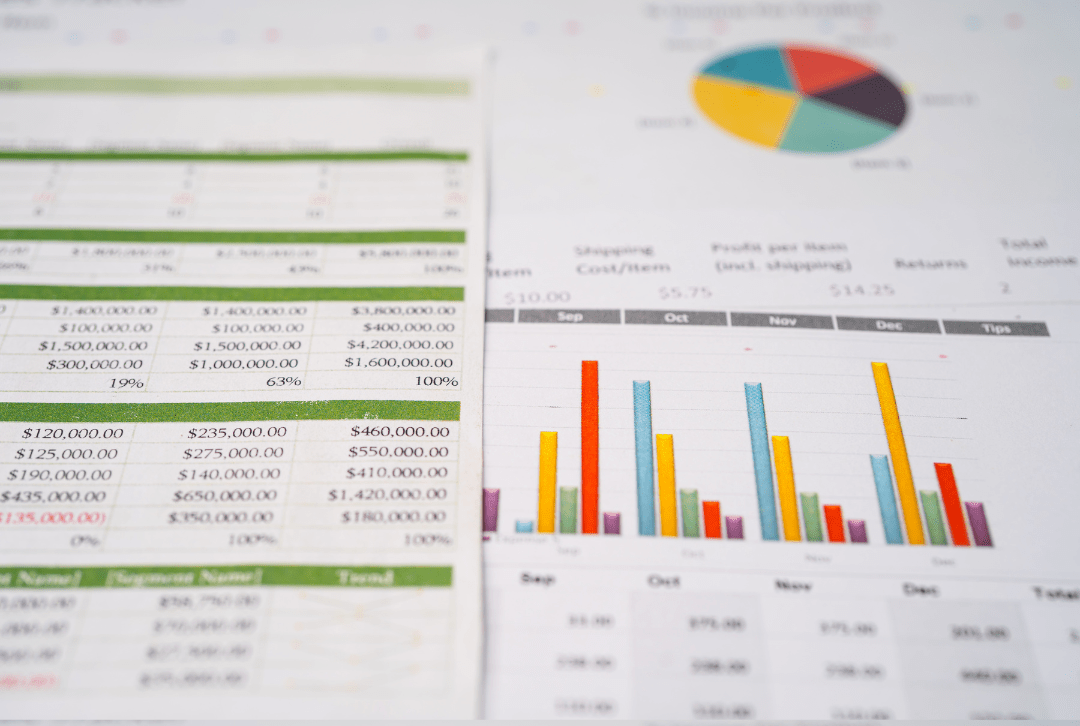

Vestwell, a leading name in the U.S. fintech sector, has recently made headlines with its remarkable $125 million Series D funding round. This funding, led by Lightspeed Venture Partners, marks a significant milestone in Vestwell’s journey, reflecting both investor confidence and the company’s pivotal role in transforming the American savings landscape.

The Funding Round

Key Investors and Strategic Growth

The Series D funding round brought together a mix of existing investors like Fin Capital, Primary Venture Partners, and FinTech Collective, along with new participants such as Blue Owl and HarbourVest. The investment is seen as a validation of Vestwell’s innovative approach and its potential to redefine the savings and retirement landscape for Americans.

Board Expansion

Notably, as part of the funding round, Justin Overdorff of Lightspeed Venture Partners has joined Vestwell’s board of directors, bringing in his expertise in business development and fintech.

Vestwell’s Growth Trajectory

Exceptional Growth Amid Economic Challenges

Despite a challenging global economic environment, Vestwell has demonstrated remarkable growth, releasing new products and securing significant partnerships with major financial institutions and state governments.

Expanding Partnerships and Market Reach

Vestwell’s collaboration with JPMorgan to expand its 401(k) product and its existing relationships with firms like Morgan Stanley underline its growing influence in the financial sector. The company’s focus on workplace retirement programs and its expansion into a broad range of savings and investment platforms have led to nearly $30 billion in assets saved across all 50 states.

The Future Vision

Scaling Business and Transforming the Industry

Looking ahead to 2024, Vestwell aims to further scale its business and continue its transformative impact on the savings industry. The company plans to introduce more savings vehicles to its platform, thereby expanding its reach to more businesses and individuals.

Closing the American Savings Gap

Vestwell’s efforts are not just limited to business expansion but also aim at addressing a crucial societal issue – the American savings gap. By providing simplified savings solutions, Vestwell is enabling small and emerging businesses to offer workplace savings programs, thus bridging the gap in financial security for many Americans.

Conclusion

Vestwell’s Series D funding round is more than just a financial boost; it’s a testament to the company’s innovative spirit and its commitment to redefining the savings and investment landscape in the United States. With new products, partnerships, and a clear vision for the future, Vestwell stands at the forefront of a financial revolution, poised to bring about significant changes in the way Americans save and invest.