Plum, the UK-based smart money management app, has successfully secured £16 million in a Series B funding round. This significant financial injection comes as the company continues its rapid growth trajectory, having recently tripled its assets under management (AUM) to over £1 billion. The fresh capital is expected to bolster Plum’s path toward profitability, with strategic plans to expand its product offerings and customer base across Europe.

Table of Contents

ToggleBackground on Plum

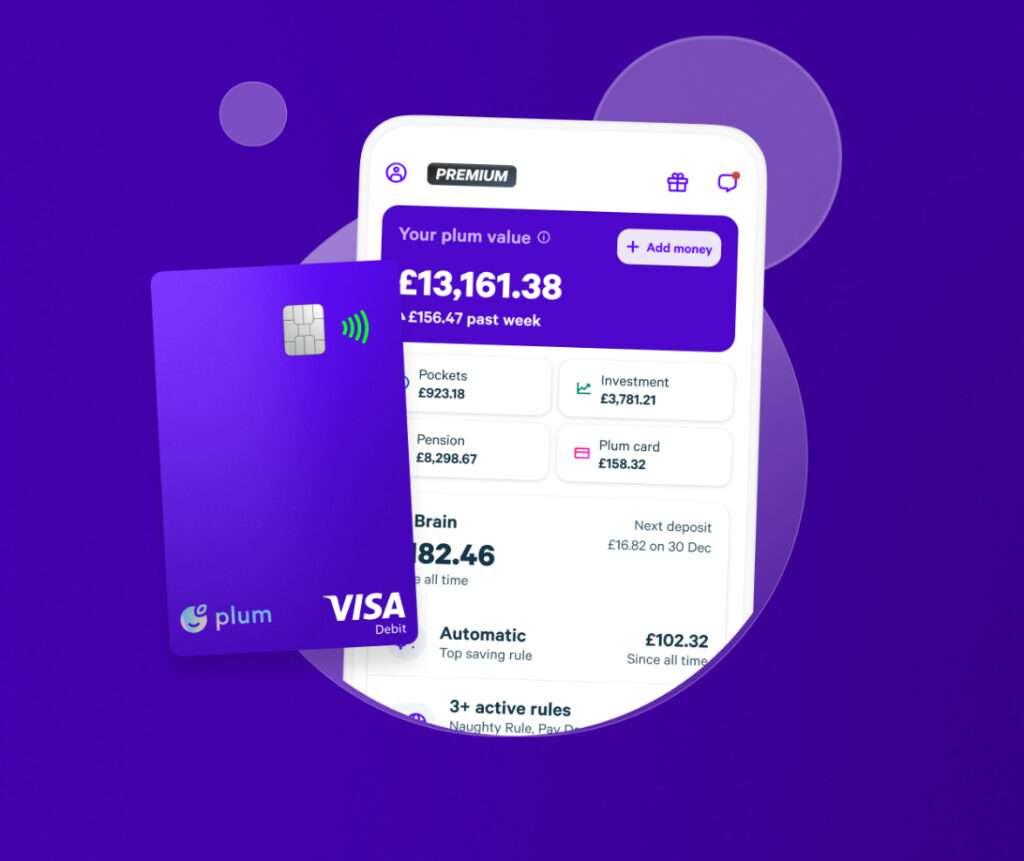

Plum was founded in 2016 with the mission to automate personal finance management and help users grow their savings effortlessly. The app uses AI to analyze users’ spending patterns and automates savings and investments. Over the years, Plum has evolved its product suite to include various savings and investment tools, such as Cash ISAs and exchange-traded funds (ETFs). The company’s innovative approach has attracted over 2 million users across 10 European markets, showcasing its substantial impact on the fintech landscape.

Details of the Funding Round

In its latest Series B funding round, Plum raised a total of £16 million. The round was led by institutional investors, who contributed £13.4 million. Notable investors include Eurobank, iGrow Venture Capital, Venture Friends, and Ventura Capital. Additionally, Plum secured £2.7 million through a crowdfunding campaign on Crowdcube, which saw participation from over 5,500 investors from the UK and EU.

Eurobank’s involvement is particularly significant, as it marks their continued support following a previous €10 million minority equity investment. This backing underscores the confidence major financial institutions have in Plum’s business model and growth potential. Victor Trokoudes, Plum’s founder and CEO, emphasized the importance of this funding in driving the company’s future success, stating, “Following the success of Cash ISA in the UK and ETFs in Europe, we’re well-placed to reach profitability, which is a major and important milestone for us”.

By securing this funding, Plum aims to accelerate its expansion plans, enhance its product offerings, and drive further growth in its user base and revenue streams.

Recent Achievements and Growth

Plum’s recent performance has been marked by several significant milestones. The company’s assets under management (AUM) have surged past £1 billion, tripling over the past year. This remarkable growth is largely attributed to the successful launch of the Cash ISA in the UK and ETFs in European markets, which have attracted a substantial number of new users.

The increase in AUM has been complemented by a robust rise in revenue, nearly doubling year-on-year. Plum’s subscription-based revenue model has proven effective, with average revenue per customer growing by 40%. The company’s focus on delivering value through innovative financial products has resonated with its customer base, leading to increased engagement and higher retention rates.

Plum’s expansion strategy has not only focused on product development but also on geographical growth. The app now serves over 2 million users across 10 European countries. This broad reach has positioned Plum as a leading player in the fintech space, catering to a diverse customer base with varying financial needs.

Future Plans and Goals

Looking ahead, Plum has ambitious plans to sustain its growth momentum and achieve profitability by 2025. The company is set to expand its product offerings further, with new features and financial products in the pipeline designed to enhance user experience and drive customer acquisition. These upcoming products aim to solidify Plum’s position as a comprehensive financial management tool.

Plum’s strategic focus includes deepening its market penetration in existing territories while exploring new markets across Europe. The partnership with Eurobank is a critical component of this strategy, facilitating Plum’s entry into the Greek market. The company aims to reach millions of customers in Greece by the end of 2027, leveraging Eurobank’s local expertise and distribution network.

Moreover, Plum is committed to continuous innovation. The company plans to introduce “game-changing products” that will elevate its app to the next level. These products are expected to cater to both existing and new customers, offering advanced features that promote better financial management and savings growth.

Industry Context and Implications

Plum’s impressive growth and successful funding round reflect broader trends in the fintech industry. The demand for smart financial management tools has been increasing, driven by consumers’ need for more control over their finances. Plum’s AI-driven approach addresses this demand by providing personalized savings and investment solutions, making financial management accessible to a wider audience.

The fintech sector is witnessing a wave of democratization, where services traditionally reserved for high-net-worth individuals are now available to the general public. Plum’s mission aligns with this trend, as it aims to democratize financial management and make savings and investment accessible to all. This approach not only benefits consumers but also challenges traditional financial institutions to innovate and adapt.

Plum’s success also highlights the importance of strategic partnerships and diversified funding sources in driving growth. The involvement of institutional investors and a large pool of crowdfunders underscores the confidence in Plum’s business model and its potential for long-term success. As Plum continues to expand and innovate, it sets a precedent for other fintech startups aiming to disrupt the financial services industry.

Conclusion

Plum’s latest funding round marks a significant milestone in its journey toward becoming a leading financial management app. The £16 million Series B funding, supported by institutional investors like Eurobank and iGrow Venture Capital, along with a successful crowdfunding campaign, underscores the strong confidence in Plum’s innovative approach to personal finance.

With over 2 million users and assets under management surpassing £1 billion, Plum’s rapid growth is a testament to its effective use of AI in automating savings and investments. The company’s strategic focus on expanding its product offerings, including the successful launch of Cash ISAs and ETFs, has been pivotal in driving customer engagement and revenue growth.

Looking ahead, Plum aims to achieve profitability by 2025, with plans to further enhance its financial products and expand its presence across Europe, particularly through its partnership with Eurobank in Greece. The company’s commitment to continuous innovation, including the integration of generative AI models, will likely play a crucial role in shaping its future success.

As the fintech industry continues to evolve, Plum’s ability to adapt and innovate positions it well to meet the growing demand for smart financial management solutions. The company’s journey reflects broader trends in the sector, emphasizing the democratization of financial services and the increasing importance of personalized, AI-driven financial tools.

Plum’s recent achievements and strategic plans not only highlight its potential for future growth but also set a benchmark for other fintech startups aiming to transform the financial services landscape. As Plum moves forward, it remains focused on its mission to make financial management accessible and effective for everyone, paving the way for a more financially secure future for its users.