In recent years, North Carolina has emerged as a beacon of innovation and growth in the financial technology (fintech) sector. At the heart of this transformation is the Triangle area, where a blend of academic excellence, entrepreneurial spirit, and a supportive economic environment has fostered a thriving ecosystem for fintech companies.

Table of Contents

ToggleThe Triangle: A Nexus of Fintech Innovation

A. Booming Job Market

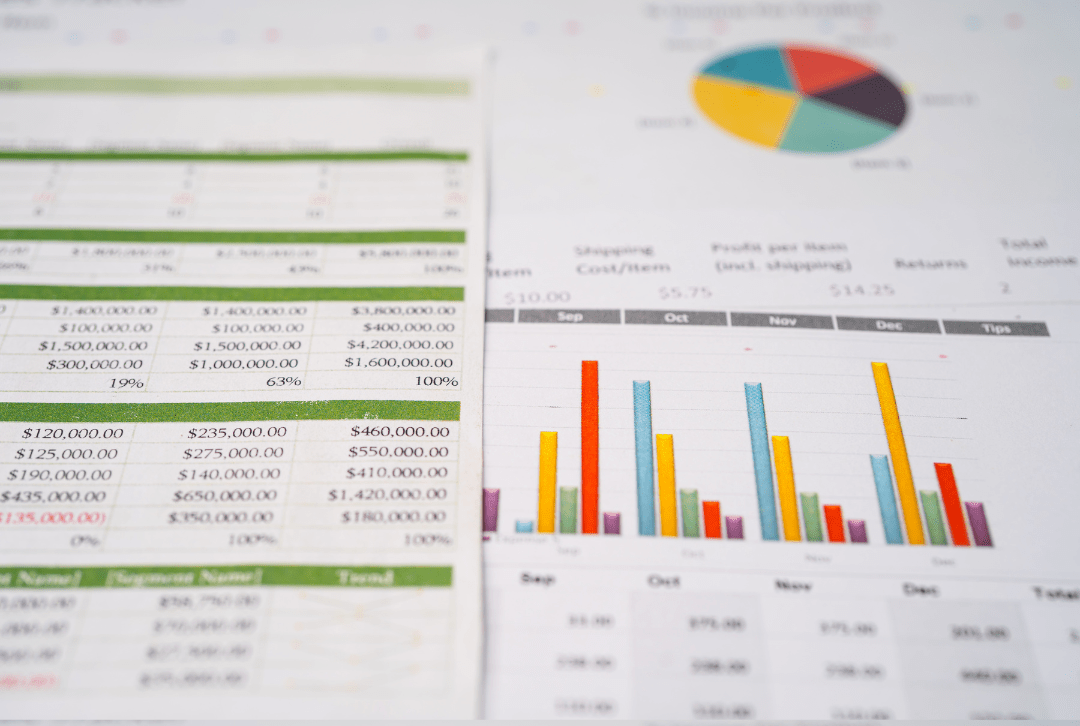

The Triangle area, encompassing Raleigh, Durham, and Chapel Hill, is witnessing an unprecedented surge in fintech job opportunities. This growth is a testament to the region’s ability to attract established companies and startups alike, drawn by the area’s rich talent pool and quality of life. Raleigh, in particular, has become a focal point for fintech activity, with thousands of companies contributing to a vibrant sector that supports tens of thousands of fintech jobs.

B. Key Players and Innovations

Major global financial institutions such as Deutsche Bank, MetLife, Bank of America, and First Citizens Bank have significantly invested in the Triangle’s fintech landscape. These investments span various digital innovations, particularly in mobile banking platforms, enhancing the region’s digital ecosystem.

The Talent Pipeline: Fueling Growth from Within

A. Academic Foundations

The Triangle’s fintech boom is closely tied to its academic institutions, such as North Carolina State University, which not only produce a steady stream of graduates ready to enter the fintech workforce but also engage in cutting-edge research and development. Local graduates are increasingly choosing to start their careers in the area, attracted by the burgeoning opportunities in fintech and other sectors.

B. Local and Global Attraction

The area’s ability to retain and attract talent is crucial to its fintech sector’s growth. Initiatives by local economic development officials and the broader community have ensured that the Triangle remains a magnet for individuals seeking a balanced and innovative work environment.

Economic and Community Impact

A. Enhancing Quality of Life

The fintech sector’s growth has had a tangible impact on the Triangle’s quality of life. By fostering high-paying fintech jobs and attracting investments, fintech companies contribute significantly to the local economy. Moreover, the presence of these companies helps to fill the downtown office spaces, further revitalizing the city centers.

B. Strengthening the Local Economy

The ripple effects of the fintech sector’s expansion extend beyond direct employment. By nurturing an ecosystem of innovation and entrepreneurship, the Triangle is setting the stage for sustained economic development and diversification.

Looking Ahead: The Future of Fintech in the Triangle

The Triangle area’s trajectory in the fintech domain is on an upward curve. With a robust pipeline of talent, a supportive economic environment, and a culture of innovation, the region is poised to continue its role as a leader in the fintech sector. The synergy between academia, industry, and government in the Triangle creates a fertile ground for future fintech ventures and technologies to flourish.

Conclusion

North Carolina’s Triangle area stands at the forefront of the fintech revolution, driven by a unique blend of talent, innovation, and strategic investments. As the sector continues to evolve, the Triangle is well-positioned to remain a key player in shaping the future of finance and technology on both a national and global scale.