Table of Contents

ToggleIntroduction

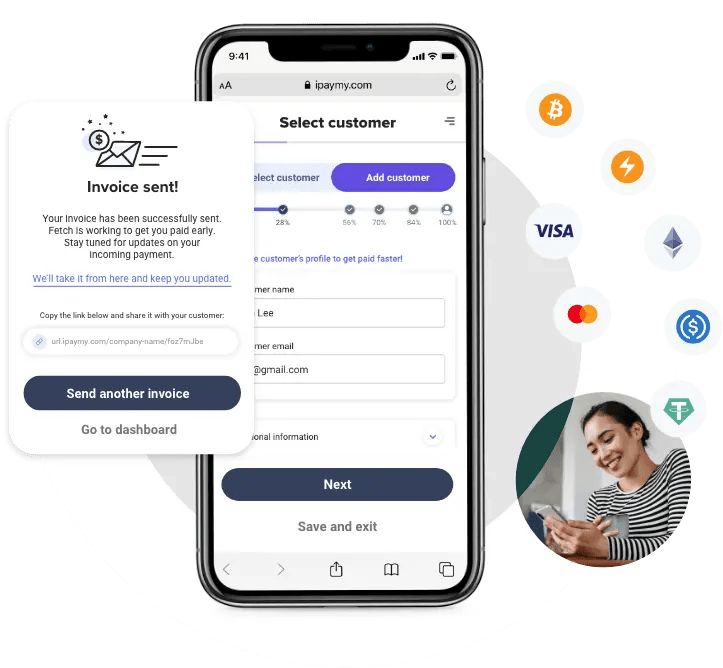

In a significant development for small to medium-sized businesses (SMBs) across Asia-Pacific regions, ipaymy has introduced Fetch, an automated invoicing platform. This groundbreaking tool is set to transform how SMBs handle their accounts receivable processes, marking a new era in financial management and customer relations.

Breaking New Ground in Financial Technology

The launch of Fetch by Singapore-based fintech company ipaymy represents a pivotal shift in the B2B payments landscape. This platform emerges as a response to the challenging reality that nearly half of all invoices in Asia are paid late, disrupting the cash flow of SMBs. Fetch stands out by automating and simplifying the accounts receivable function, a traditionally time-consuming and complex process for small businesses.

The Power of Automation in Invoicing

Fetch’s primary allure lies in its ability to streamline invoice creation, tracking, and follow-up. This automation not only saves valuable time for businesses but also speeds up the payment process, enabling SMBs to focus more on growth-driving activities. By transforming this traditionally manual process, Fetch helps reclaim precious resources, enhancing operational efficiency.

Global Reach and Diverse Payment Options

Recognizing the global aspirations of many SMBs, Fetch supports a variety of payment methods, including traditional bank transfers and cash, as well as modern alternatives like card payments and cryptocurrency. This feature is especially advantageous for businesses with a global customer base, allowing them to cater to a wider range of payment preferences without the need for additional infrastructure investments.

Encouraging Timely Payments: The Incentive Toolbox

An innovative feature of Fetch is its incentive toolbox, designed to promote on-time payments. Businesses can leverage dynamic discounts for early settlements or offer installment payment options. This flexibility not only enhances customer relations but also improves the predictability of cash flows for businesses.

Cost-Effectiveness and Rapid Settlements

In comparison to other market alternatives, Fetch offers competitive rates and quick settlement times. This aspect is crucial for smaller businesses, enabling them to accept diverse payment forms, including cards and cryptocurrency, more efficiently. Settlements could potentially be completed as quickly as the next business day, further improving liquidity for businesses.

A New Era for SME Financial Management

Fetch’s launch represents a quantum leap in technological application for small businesses. By offering an advanced level of technology previously unavailable to smaller enterprises, Fetch not only eases the challenges of payment collection but also empowers SMBs to foster better customer relationships and significantly enhance their cash flows.

Conclusion

ipaymy’s Fetch platform is a testament to the power of innovation in addressing the practical challenges faced by SMBs. With its comprehensive suite of features aimed at improving efficiency, accommodating global payment preferences, and enhancing customer relations, Fetch is poised to revolutionize the way SMBs manage their finances, heralding a new age of financial empowerment for small businesses across the Asia-Pacific region.