Canoe Intelligence, a prominent financial technology firm, has successfully raised $36 million in a Series C funding round. The round was led by Goldman Sachs, with significant participation from other key investors including Blackstone and Hamilton Lane. This funding aims to enhance Canoe’s AI-driven data automation platform, which is crucial for alternative investment firms.

Table of Contents

ToggleBackground

Company Overview: Founded in 2013 and based in New York, Canoe Intelligence specializes in automating the data management processes for institutional investors, capital allocators, and asset servicing firms. The company’s platform leverages AI and machine learning to streamline document collection, data extraction, and data processing, significantly reducing manual workloads and improving data accuracy.

Previous Funding Rounds: Before this Series C round, Canoe Intelligence had already made significant strides in securing capital. In February 2023, the company raised $25 million in a Series B round led by F-Prime Capital and Eight Roads Ventures. This funding was used to expand into European markets, enhance enterprise product offerings, and develop new data products.

Market Position: Canoe Intelligence has established itself as a key player in the fintech sector, particularly in the niche of alternative investment data management. The platform is known for its ability to automate the highly tedious and manual processes associated with alternative investments, making it a vital tool for institutional investors and asset managers.

Details of the Series C Funding

Lead Investor: Goldman Sachs led this latest funding round, underscoring the strategic importance of Canoe’s AI technology in the financial services industry. Goldman Sachs’ investment is seen as a strong endorsement of Canoe’s innovative approach to data automation.

Other Participants: The funding round also saw participation from notable investors such as Blackstone and Hamilton Lane. These investments highlight the growing confidence in Canoe’s ability to transform the alternative investment landscape through cutting-edge technology.

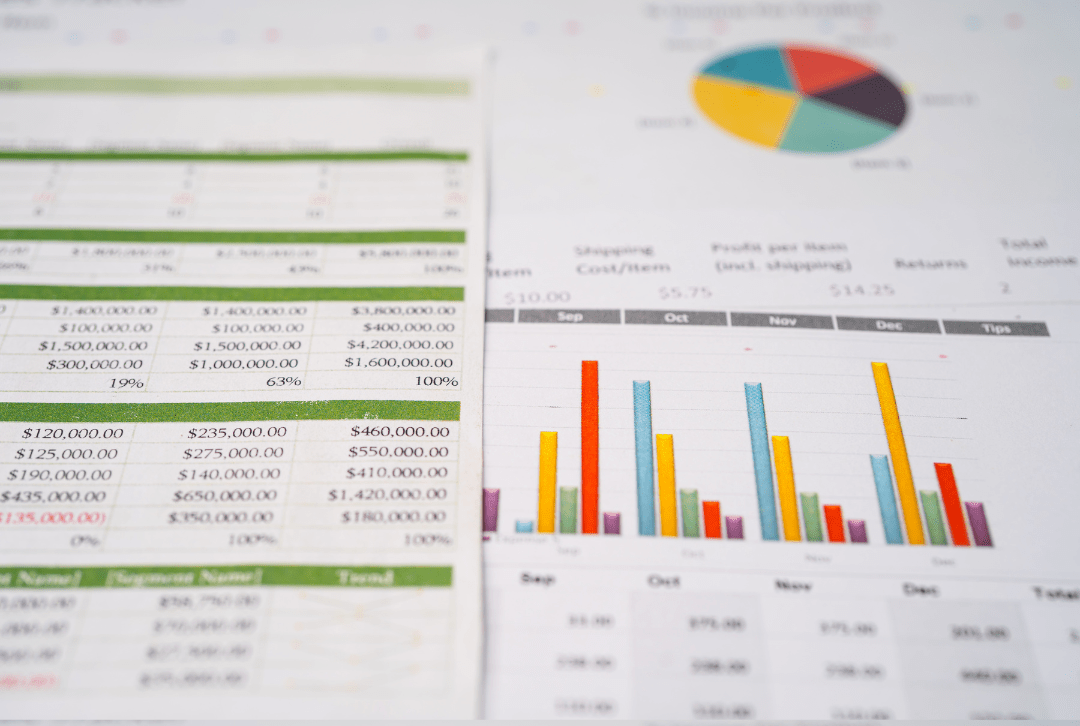

Use of Funds: The $36 million raised will be primarily used to enhance Canoe’s AI capabilities, further developing its platform to better serve its expanding client base. This includes improvements in data automation and management processes, which are critical for enabling alternative investment firms to make more informed decisions.

Impact on Canoe Intelligence

AI Development: With the new funding, Canoe Intelligence plans to significantly enhance its AI capabilities. The company’s platform already leverages advanced machine learning to automate the extraction and processing of data from investment documents, reducing manual effort and increasing accuracy. The additional funds will enable further innovation in AI to improve the platform’s efficiency and expand its functionalities, ensuring that clients receive the most sophisticated and accurate data solutions available.

Client Benefits: Canoe’s AI-driven platform provides substantial benefits to its clients, including institutional investors and wealth managers. By automating the collection and categorization of data, the platform allows clients to refocus their resources on core business activities, enhancing productivity and decision-making. The improvements in data accuracy and accessibility directly translate to better investment strategies and outcomes for clients. Additionally, the platform’s ability to process millions of documents annually ensures that clients can handle large volumes of data efficiently.

Market Expansion: The Series C funding will also support Canoe’s efforts to expand its market reach. The company plans to use the capital to grow its presence in new regions, particularly in Europe and Asia, where the alternative investment market is rapidly developing. This strategic expansion will help Canoe tap into new customer bases and strengthen its position as a global leader in alternative investment data management.

Industry Context

Trends in Fintech: The financial technology sector is seeing a significant shift towards AI and data automation. Companies like Canoe Intelligence are at the forefront of this transformation, providing tools that streamline complex data processes. The growing adoption of AI in fintech is driven by the need for efficiency, accuracy, and the ability to handle large datasets, which are critical for making informed investment decisions in the alternative investment space.

Investor Interest: Major investors, including Goldman Sachs, Blackstone, and Hamilton Lane, are increasingly focusing on fintech companies that offer innovative solutions for data management and automation. The substantial investment in Canoe Intelligence underscores the confidence that these investors have in the company’s technology and its potential to revolutionize the industry. This trend reflects a broader movement towards supporting fintech innovations that address key challenges in financial data management.

Competitor Landscape: Canoe Intelligence operates in a competitive landscape with several other fintech firms aiming to simplify and enhance investment data processes. However, Canoe’s unique combination of AI-driven technology and its focus on alternative investments set it apart. The company’s continuous innovation and ability to secure significant funding demonstrate its competitive edge and strong positioning in the market. As Canoe continues to develop its platform and expand its market presence, it is well-positioned to maintain its leadership in the industry.

Conclusion

The successful $36 million Series C funding round led by Goldman Sachs marks a significant milestone for Canoe Intelligence, providing the resources needed to enhance its AI-driven platform and expand its market reach. With this new capital, Canoe is poised to further revolutionize data automation in the alternative investment industry, offering enhanced accuracy and efficiency to its clients. As the fintech sector continues to evolve, Canoe’s commitment to innovation and its strategic growth plans position it as a key player in the global financial technology landscape. This funding not only validates Canoe’s existing achievements but also sets the stage for future advancements and market leadership.