In a significant move within New Zealand’s financial sector, the Bank of New Zealand (BNZ) has acquired BlinkPay, a Māori-led fintech specializing in open banking solutions. This acquisition underscores BNZ’s commitment to enhancing its digital capabilities and reflects the growing importance of open banking in the region.

Table of Contents

ToggleBackground on BNZ and BlinkPay

BNZ Overview: Established in 1861, the Bank of New Zealand is one of the country’s leading financial institutions, offering a comprehensive range of banking services to personal, business, and agribusiness clients. With a strong focus on innovation, BNZ has been at the forefront of integrating digital solutions to meet evolving customer needs.

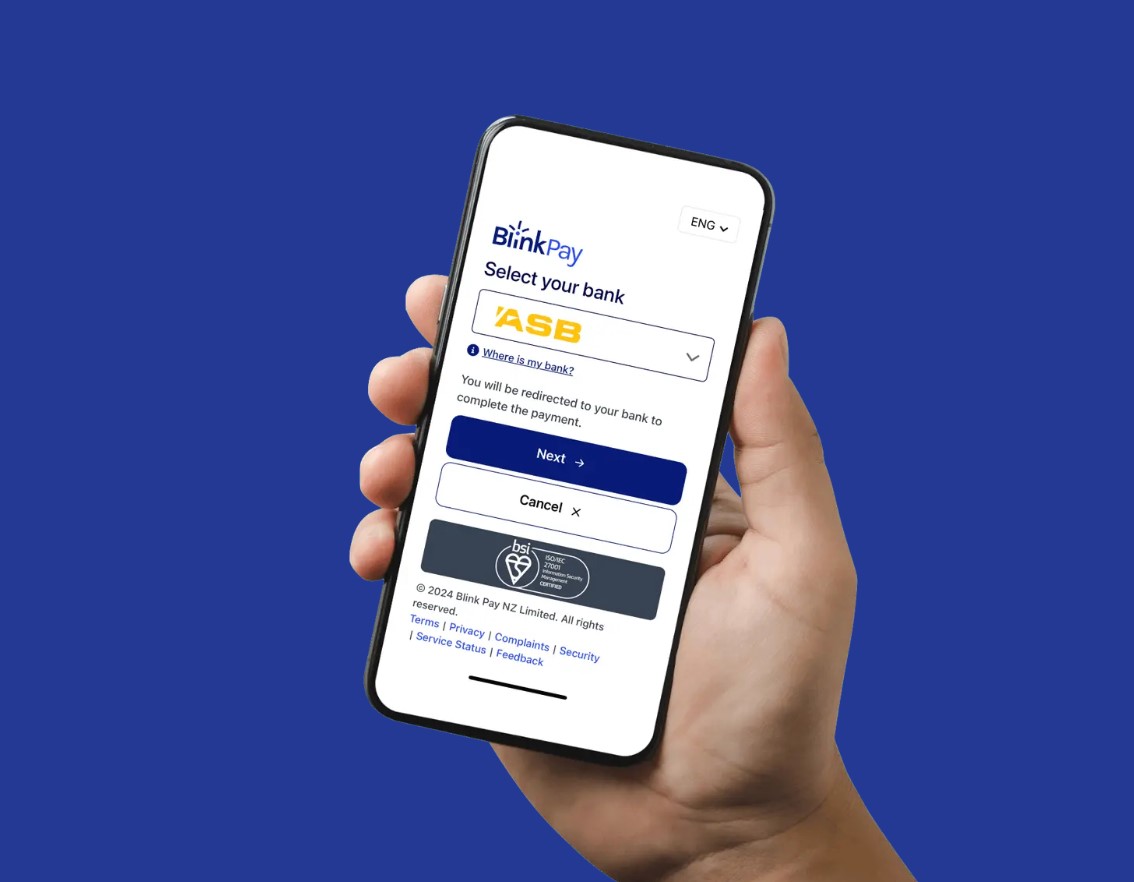

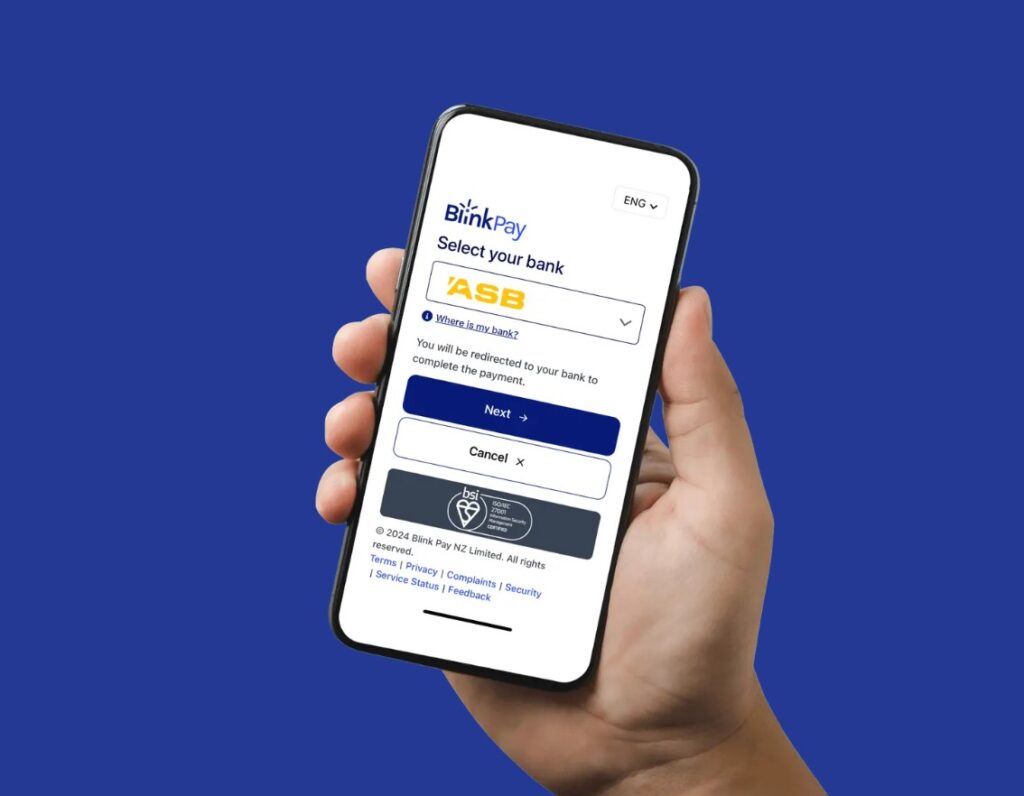

BlinkPay Overview: Founded in 2015, BlinkPay is a pioneering Māori-owned fintech company that has developed a suite of open banking payment services. The company has established connections with all major local banks, facilitating seamless and secure transactions for consumers and businesses alike. BlinkPay’s commitment to innovation and cultural values has positioned it as a significant player in New Zealand’s fintech landscape.

Details of the Acquisition

On November 2024, BNZ announced its acquisition of BlinkPay, aiming to bolster its open banking capabilities and drive further innovation in digital payment solutions. As part of the acquisition, Adrian Smith, co-founder of BlinkPay, will assume the role of CEO under BNZ’s ownership, ensuring continuity in leadership and strategic vision. While specific financial terms of the deal have not been publicly disclosed, the acquisition is expected to accelerate the development of new products and services within BNZ’s digital portfolio.

Strategic Goals of the Acquisition

BNZ’s acquisition of BlinkPay aligns with its strategic objective to enhance digital banking services and strengthen its position in New Zealand’s evolving financial landscape. By integrating BlinkPay’s open banking solutions, BNZ aims to offer customers more seamless and secure payment options, thereby improving user experience and operational efficiency. This move also reflects BNZ’s commitment to fostering innovation and supporting indigenous enterprises within the fintech sector.

Significance for New Zealand’s Open Banking Landscape

The acquisition marks a pivotal moment in New Zealand’s open banking journey. Open banking allows consumers to securely share their financial data with third-party providers, leading to more personalized and competitive financial services. BNZ’s integration of BlinkPay’s technology is expected to accelerate the adoption of open banking practices across the country, promoting greater competition and innovation within the financial sector. This development aligns with the broader industry trend towards more transparent and customer-centric banking solutions.

Implications for Māori Representation in Fintech

BlinkPay’s establishment as a Māori-led fintech has been a significant milestone in promoting indigenous participation in New Zealand’s technology and financial sectors. The acquisition by BNZ not only validates BlinkPay’s contributions but also highlights the importance of diversity and inclusion in driving innovation. By maintaining leadership roles for BlinkPay’s founders post-acquisition, BNZ demonstrates a commitment to preserving the cultural values and perspectives that have been integral to BlinkPay’s success. This move is anticipated to inspire further Māori involvement in fintech and other emerging industries.

Future Prospects

The acquisition of BlinkPay by BNZ is poised to significantly enhance New Zealand’s open banking landscape. By integrating BlinkPay’s innovative payment solutions, BNZ aims to offer customers more seamless and secure financial services. This move aligns with the broader industry trend towards open banking, which promotes transparency and customer-centric banking solutions. The collaboration is expected to accelerate the adoption of open banking practices across the country, fostering greater competition and innovation within the financial sector.

Conclusion

BNZ’s acquisition of BlinkPay marks a pivotal moment in New Zealand’s financial sector, highlighting the growing importance of open banking and the value of indigenous innovation. This strategic move not only enhances BNZ’s digital capabilities but also underscores the significance of diversity and inclusion in driving industry advancements. As the integration progresses, customers can anticipate more personalized and efficient banking services, reflecting the evolving landscape of New Zealand’s financial industry.